With the financial collapse of 2008 still very much in our minds, we have to ask ourselves, how are we going to protect our investment funds from unforeseeable financial catastrophes?

It was extremely difficult to avoid this downturn if you had your money in a managed pension fund, and consequently, the values of the funds will have dropped.

Closing the door after the horse has bolted is a very common knee-jerk reaction. When share prices drop, if you sell them at that point, then the chances of benefitting when the market changes direction is lost. However, this does not help investors who feel “once bitten, twice shy”.

The FTSE 100 index (that’s the shares of the leading 100 UK companies) went from a high of over 6,500 points in early 2008 to circa 3,500 points by March 2009 – a drop of circa 46%. However, the FTSE 100 is currently back at circa 5,300 points, which is a recovery of 51% from the low point, or 18% down on the high of 6,500 in early 2008. So, what started out as a loss of 46% would, if the investor had had the faith to stay put, have only ended up an 18% loss. This is still not ideal, but significantly better than the alternative of selling at the bottom.

Cash offers short-term security, but cash rates have been slashed in line with the reductions of the Bank of England Base Rate to about 1% to 3%, but this is not the 51% bounce that the market had. If you switched to cash at the bottom, and missed the recovery, you would still be feeling pretty sore.

I am often asked “How could the fund manager let my money disappear like that? Surely he should have done something to protect me?” The simple answer is very rarely. This year I have had so many new clients coming to me, who previously had poor advice from other advisers. My role has essentially been that of a loss counsellor – trying to provide a strategy that offered a means of recouping losses, whilst addressing the concerns of the clients about future investment risk. Sadly, there is no crystal ball, but certain strategies may give some comfort to clients.

One such investment type is called “Absolute Return”. This innocuous title belies an investment flexibility that might just save your bacon. Absolute Return funds aim to deliver year on year positive returns, typically targeted on cash returns plus a margin (e.g. LIBOR + 2%), or similar targets. Hitting the target is not guaranteed, however!

Absolute Return funds have the flexibility to use shares, cash and other investment types; the fund manager can decide when to be in shares, and when to dash for cash to protect profits made from shares, if markets turn bad.

A FTSE 100 fund, for instance, can’t do this, as it can only invest in shares. This is not always ideal.

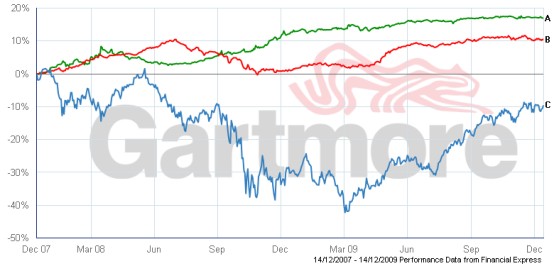

The top two lines, A and B, represent 2 leading Absolute Return funds; the bottom line C, represents the FTSE 100 over the past 2 years. The Absolute Return funds have been less volatile than the FTSE 100, and over a 2 year period their return has been positive.

Absolute Return funds can be incorporated into investment strategies for pensions, Child Trust Funds, and other family savings plans.

If you would like to know more about this article please contact Christopher Hunter of AFH Wealth Management Ltd atchristopher.hunter@afhgroup.com ; Tel: 01527 577775 or 07814 195616.

The article above is generic information only and should not be deemed as advice. Please contact us for further information.